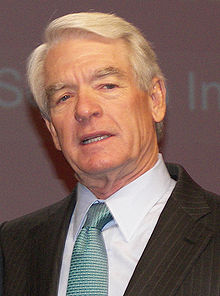

Charles R. Schwab – Billionaire

Charles Robert Schwab (born July 29, 1937) is an American investor, financial executive, and philanthropist. He is the founder of the Charles Schwab Corporation. He pioneered discount sales of equity securities starting in 1975. His company became by far the largest discount securities dealer in the United States. He retired as CEO in 2008, but remains chairman and is the largest shareholder.

As of February 2017, his net worth is estimated by Forbes Magazine to be $8.2 billion USD, making him 76th richest man on the Forbes 400.

Early life and education

Schwab was born in Sacramento, California, the son of Terrie and Lloyd Schwab. He attended Santa Barbara High School in Santa Barbara, California, and was captain of the golf team. He attended pre-college school at Holy Rosary Academy in Woodland, California. Schwab graduated from Stanford University in 1959 with a B.A. in economics. In 1961, he graduated from Stanford Graduate School of Business with an MBA. Schwab is a knight of the Sigma Nu fraternity.

Investment career

In 1963, Chuck Schwab and three other partners launched Investment Indicator, an investment newsletter. At its height, the newsletter had 3,000 subscribers, each paying $84 a year to subscribe. In April 1971, the firm incorporated in California as First Commander Corporation, a wholly owned subsidiary of Commander Industries, Inc., to offer traditional brokerage services and publish the Schwab investment newsletter. In November of that year, Schwab and four others purchased all the stock from Commander Industries, Inc. In 1972, Schwab bought all the stock from what was once Commander Industries.

Charles Schwab & Co.

In 1973, First Commander changed its name to Charles Schwab & Co., Inc.. A decisive turning point came in 1975, when the federal Securities and Exchange Commission deregulated the securities industry. Companies could then charge any fees they wanted. Schwab had long complained that the established firms showed little concern for the needs of their customers. Financial securities were not bought by consumers, they were sold by salesman, who made higher commissions and profits by selling riskier securities regardless of the disadvantages to the consumers. Schwab set up a series of radically different policies. First, the charges to consumers were cut in half. Second, salesmen are and were paid hourly salaries, rather than commissions on the total sale price. Third, Schwab refused to offer any advice to the customer. It also set up a toll-free number to take orders nationwide and later set up 24-7 system that would allow customers to place orders from anywhere at any time. Established firms were outraged, and tried to block Schwab’s expansion.

Source:wikipedia