David Rubenstein – Billionaire

David Mark Rubenstein (born August 11, 1949) is an American financier and philanthropist best known as co-founder and co-chief executive officer of The Carlyle Group, a global private equity investment company based in Washington D.C. He is also currently serving as chairman of the Kennedy Center for the Performing Arts, co-chair of the board of trustees at the Brookings Institution, and chairman of the board of trustees at Duke University, his alma mater. According to the Forbes ranking of the wealthiest people in America, Rubenstein has a net worth of $2.5 billion.

Early life and education

Rubenstein grew up an only child in a Jewish family in an exclusively Jewish neighborhood in Baltimore. His beginnings were modest. His father was employed by the United States Postal Service and his mother was a homemaker.

He graduated from the college preparatory high school Baltimore City College, at the time an all-male school, and then from Duke University Phi Beta Kappa and magna cum laude in 1970. He earned his law degree from the University of Chicago Law School in 1973, where he was an editor of the University of Chicago Law Review.

Business career

Early law career

From 1973 to 1975, Rubenstein practiced law in New York with Paul, Weiss, Rifkind, Wharton & Garrison. Prior to starting Carlyle in 1987, with William E. Conway, Jr. and Daniel A. D’Aniello, Rubenstein was a deputy domestic policy advisor to President Jimmy Carter and worked in private practice in Washington, D.C.

In private equity

According to A Pursuit of Wealth by Sicelo P. Nkambule, David Rubenstein expressed fear that the private equity boom would end in January 2006 stating: “This has been a golden age for our industry, but nothing continues to be golden forever”. One month later, he stated: “Right now we’re operating as if the music’s not going to stop playing and the music is going to stop. I am more concerned about this than any other issue”. According to Nkambule: “These concerns proved to be right as at the end of 2007 the buyout market collapsed…As leveraged loan activity came to an abrupt stop, private equity firms were unable to secure financing for their transactions.”

In May 2008 David Rubenstein stated: “But once this period is over, once the debt on the books of the banks is sold and new lending starts, I think you’ll see the private equity industry coming back in what I call the Platinum Age – better than it’s ever been before. I do think that the private equity industry has a great future and that the greatest period for private equity is probably ahead of us.”

| David Rubenstein | |

|---|---|

|

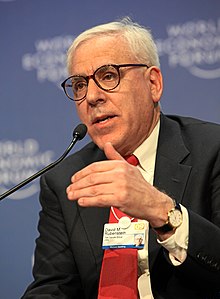

David M. Rubenstein at the World Economic Forum annual meeting in Davos, 2009

|

|

| Born | August 11, 1949 Baltimore, Maryland, U.S. |

| Nationality | United States |

| Alma mater | Duke University University of Chicago |

| Occupation | Co-Founder and Co-CEO of The Carlyle Group |

| Net worth | |

| Spouse(s) | Alice Nicole Rogoff |

| Children | Alexandra, Gabrielle, and Andrew |

| Website | http://www.davidrubenstein.com/ |

Source:wikipedia